FINANCE

FINANCE

FINANCE

How We Improved Efficiency and Scalability for a SMB Lending Company by 73.5%

How We Improved Efficiency and Scalability for a SMB Lending Company by 73.5%

How We Improved Efficiency and Scalability for a SMB Lending Company by 73.5%

Dedicated Team | Data Engineering | Data Science

Dedicated Team | Data Engineering | Data Science

Overview

Overview

Overview

Optimizing Technology for Efficient Lending

Reliance Financial, a leading SMB lending company, faced significant operational challenges due to manual workflows and disjointed systems, which hindered scalability and real-time decision-making. The objective of this project was to overhaul their technology infrastructure, integrating APIs, automating financial workflows, and building scalable data pipelines for enhanced performance. By providing Fractional CTO services, we delivered a comprehensive technical solution aligned with the company’s business goals, enabling them to manage rapid growth without sacrificing accuracy or efficiency.

Reliance Financial, a leading SMB lending company, faced significant operational challenges due to manual workflows and disjointed systems, which hindered scalability and real-time decision-making. The objective of this project was to overhaul their technology infrastructure, integrating APIs, automating financial workflows, and building scalable data pipelines for enhanced performance. By providing Fractional CTO services, we delivered a comprehensive technical solution aligned with the company’s business goals, enabling them to manage rapid growth without sacrificing accuracy or efficiency.

40%

Reduction in Manual Effort

Automation of KPI tracking reduced manual processes by 40%.

40%

Reduction in Manual Effort

Automation of KPI tracking reduced manual processes by 40%.

40%

Reduction in Manual Effort

Automation of KPI tracking reduced manual processes by 40%.

100,000

API Transactions/Month

Managed over 100,000 API transactions per month with no downtime, ensuring seamless integration.

100,000

API Transactions/Month

Managed over 100,000 API transactions per month with no downtime, ensuring seamless integration.

100,000

API Transactions/Month

Managed over 100,000 API transactions per month with no downtime, ensuring seamless integration.

95%

Accuracy Improvement in Underwriting

Enhanced data pipelines identified outliers and variances, improving underwriting accuracy and optimizing risk assessments by 95%.

95%

Accuracy Improvement in Underwriting

Enhanced data pipelines identified outliers and variances, improving underwriting accuracy and optimizing risk assessments by 95%.

95%

Accuracy Improvement in Underwriting

Enhanced data pipelines identified outliers and variances, improving underwriting accuracy and optimizing risk assessments by 95%.

The Challenge

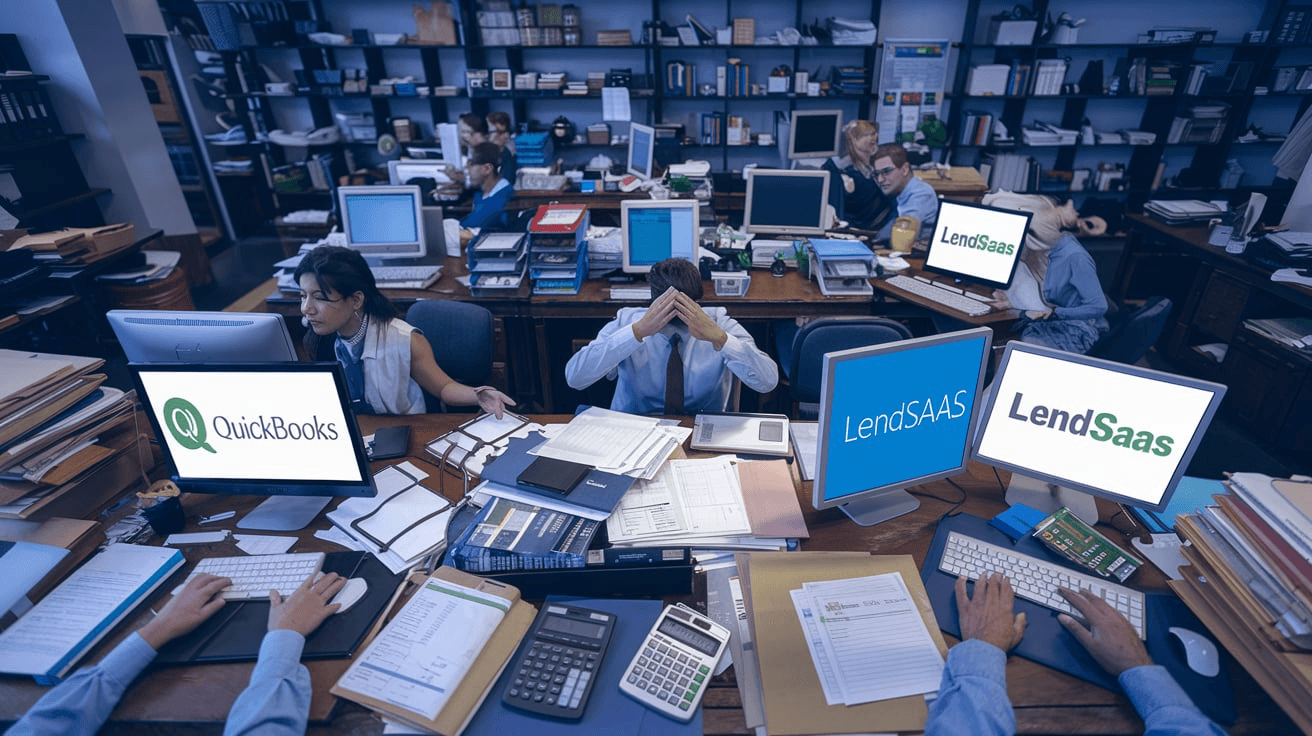

Reliance Financial’s existing system was unable to support their rapid growth in SMB lending. Manual processes were time-consuming, error-prone, and lacked scalability. The lack of API integration between key platforms, like QuickBooks and LendSaaS, hindered efficiency. Real-time data access and reporting were almost non-existent, making informed decision-making difficult.

The Impact

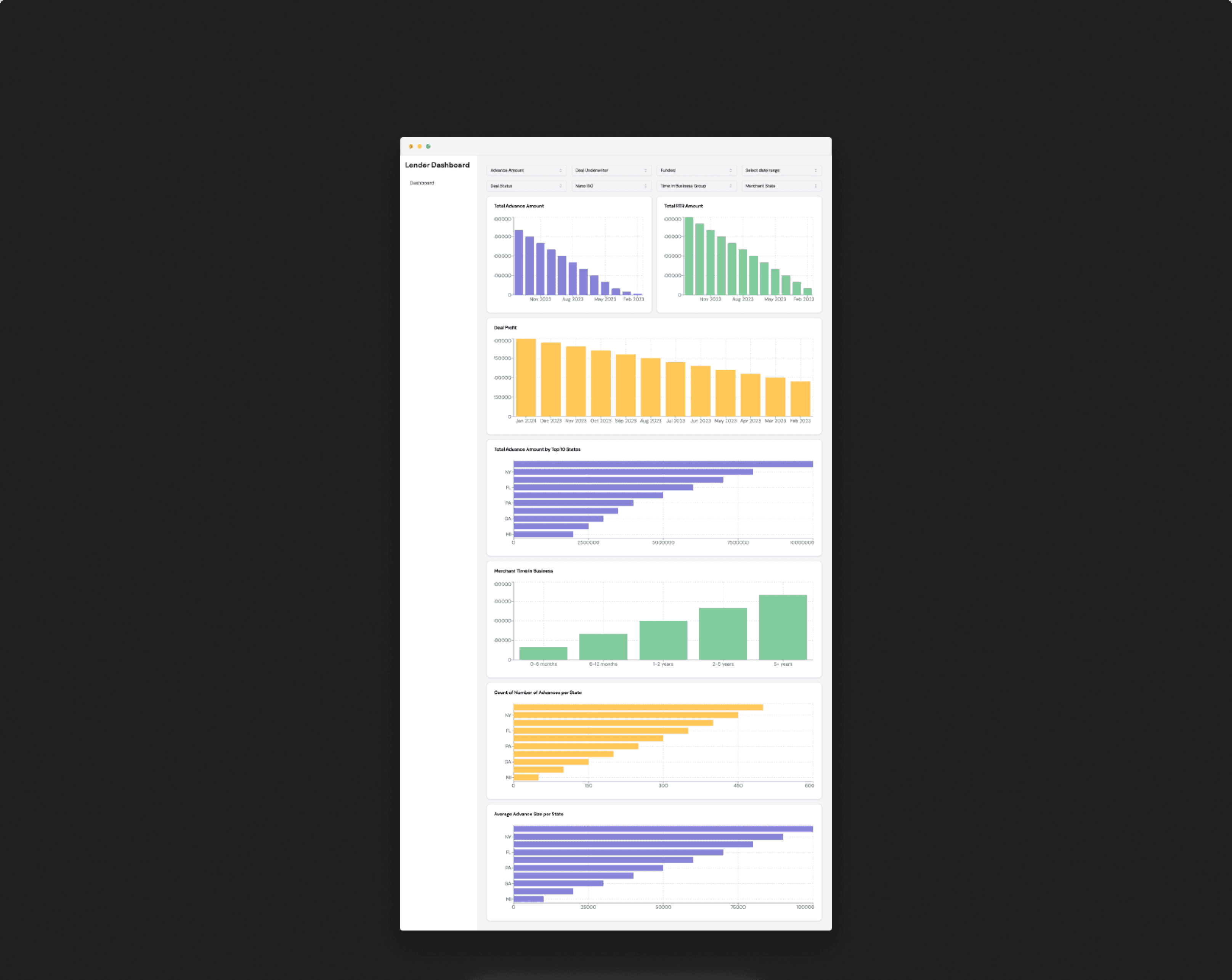

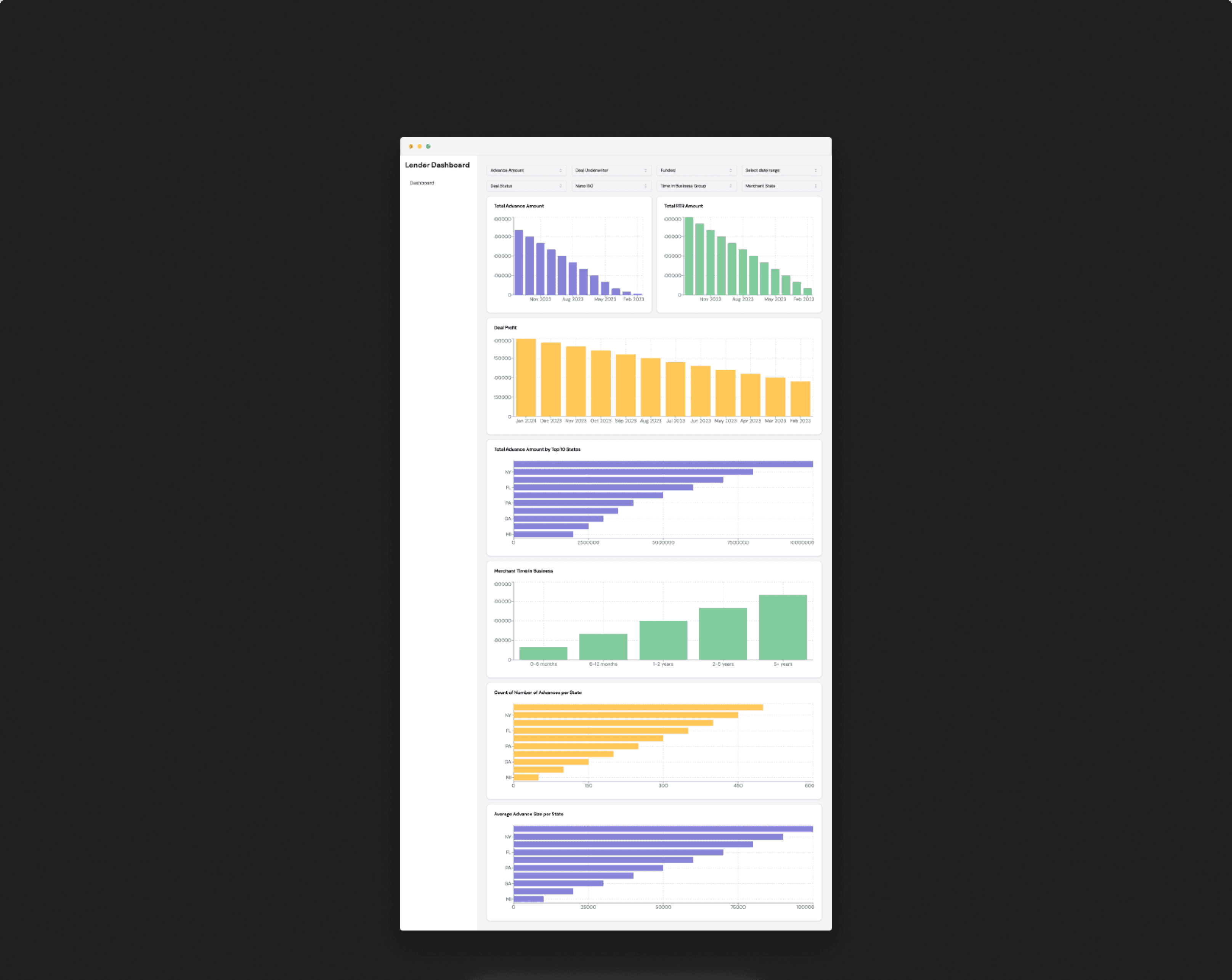

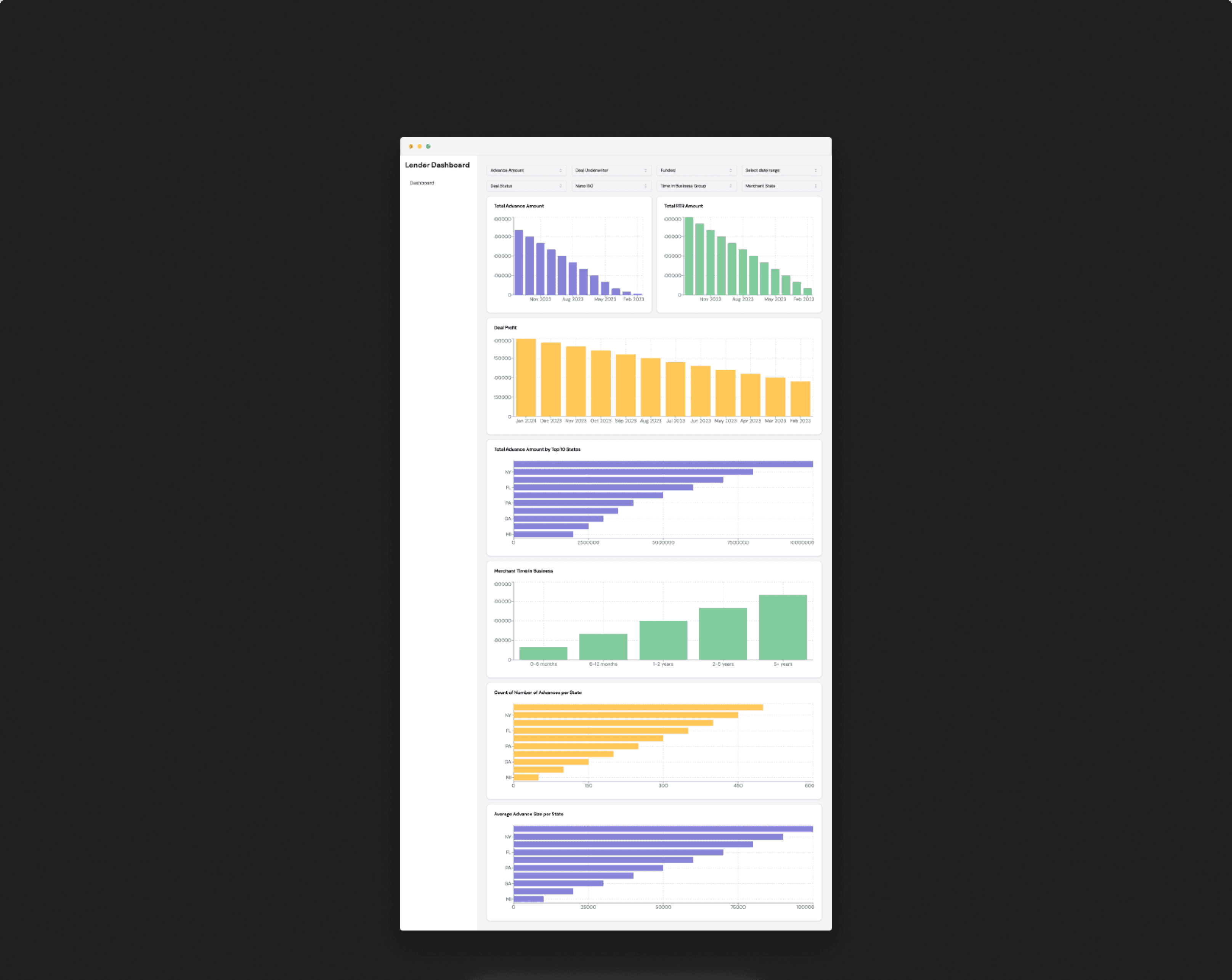

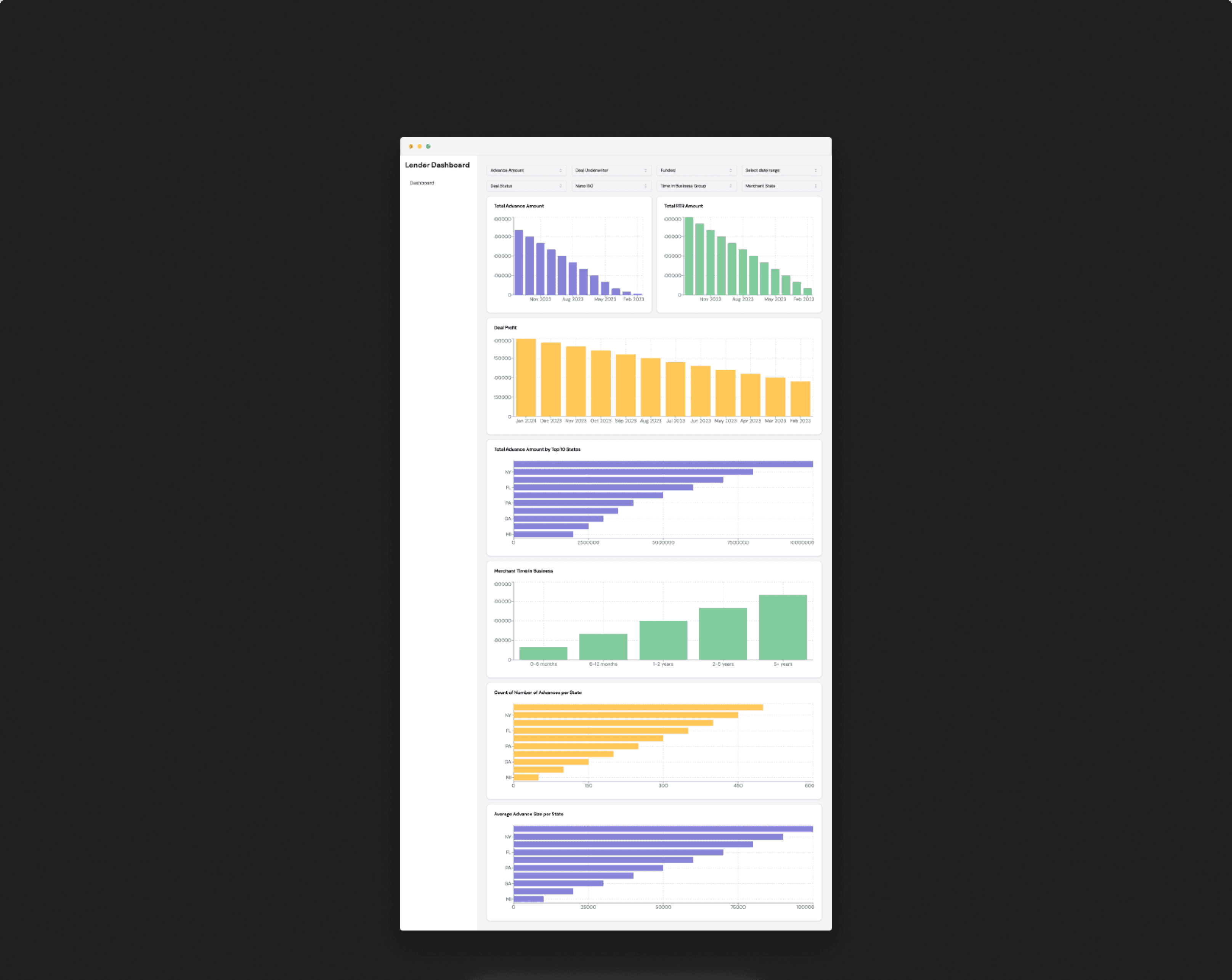

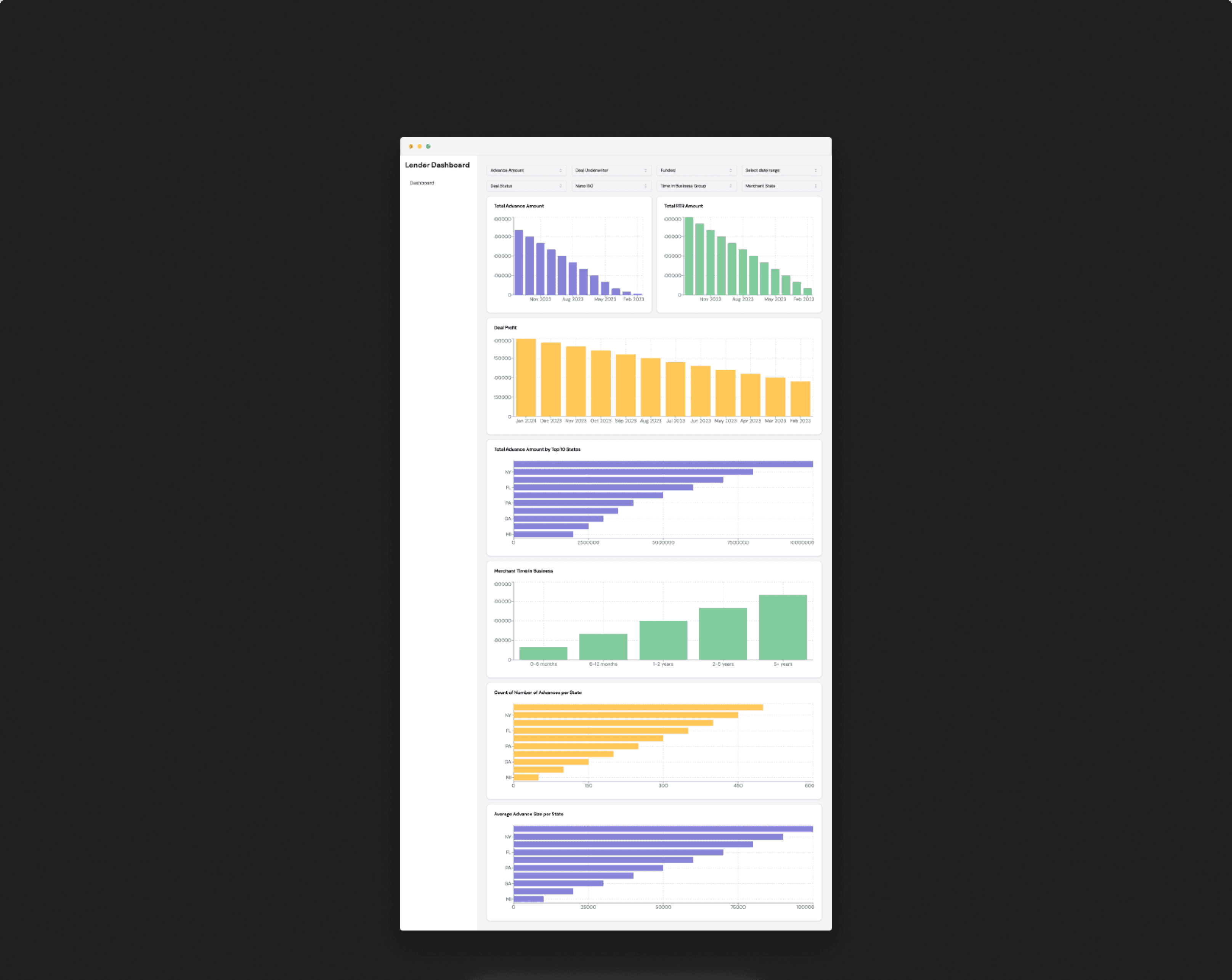

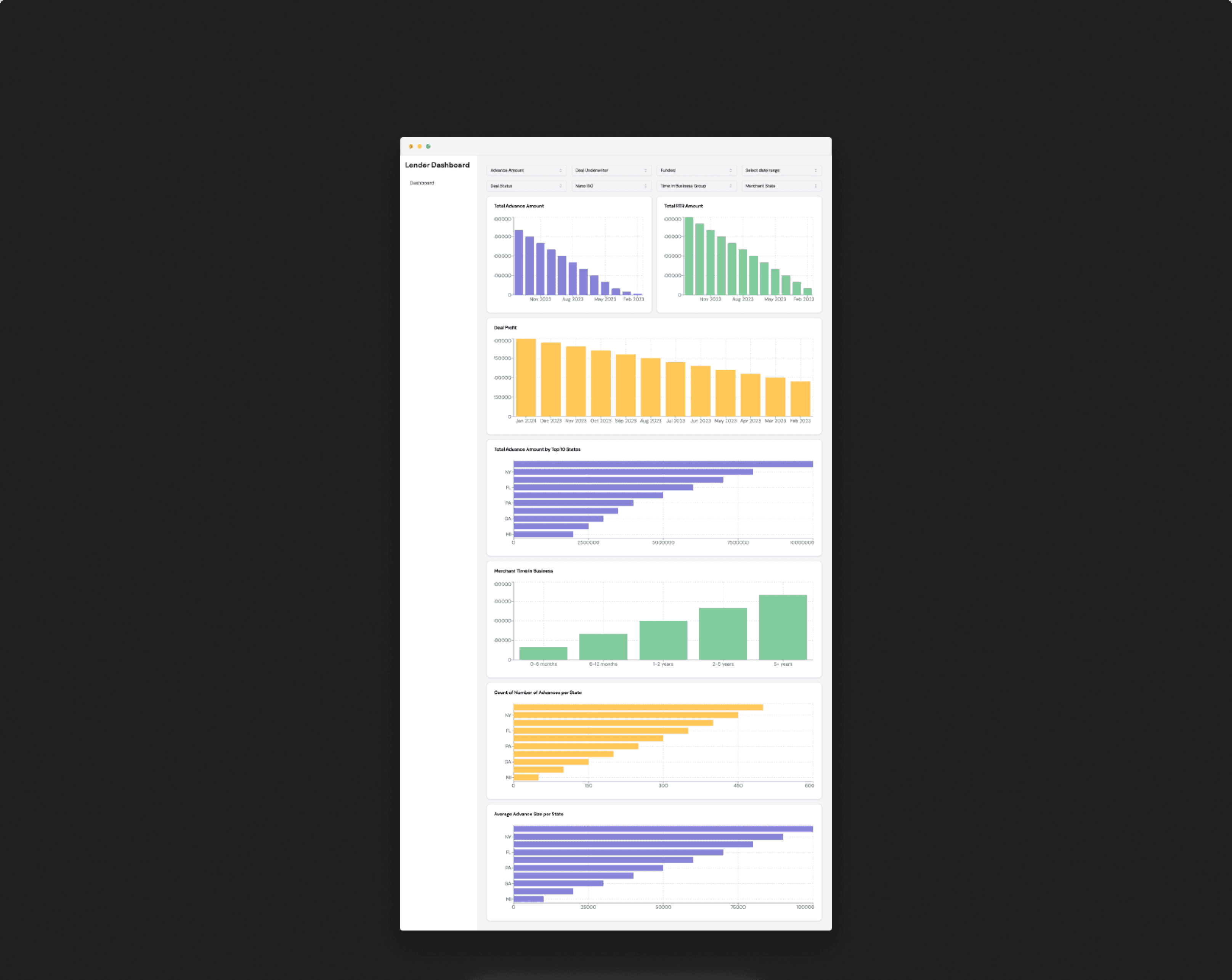

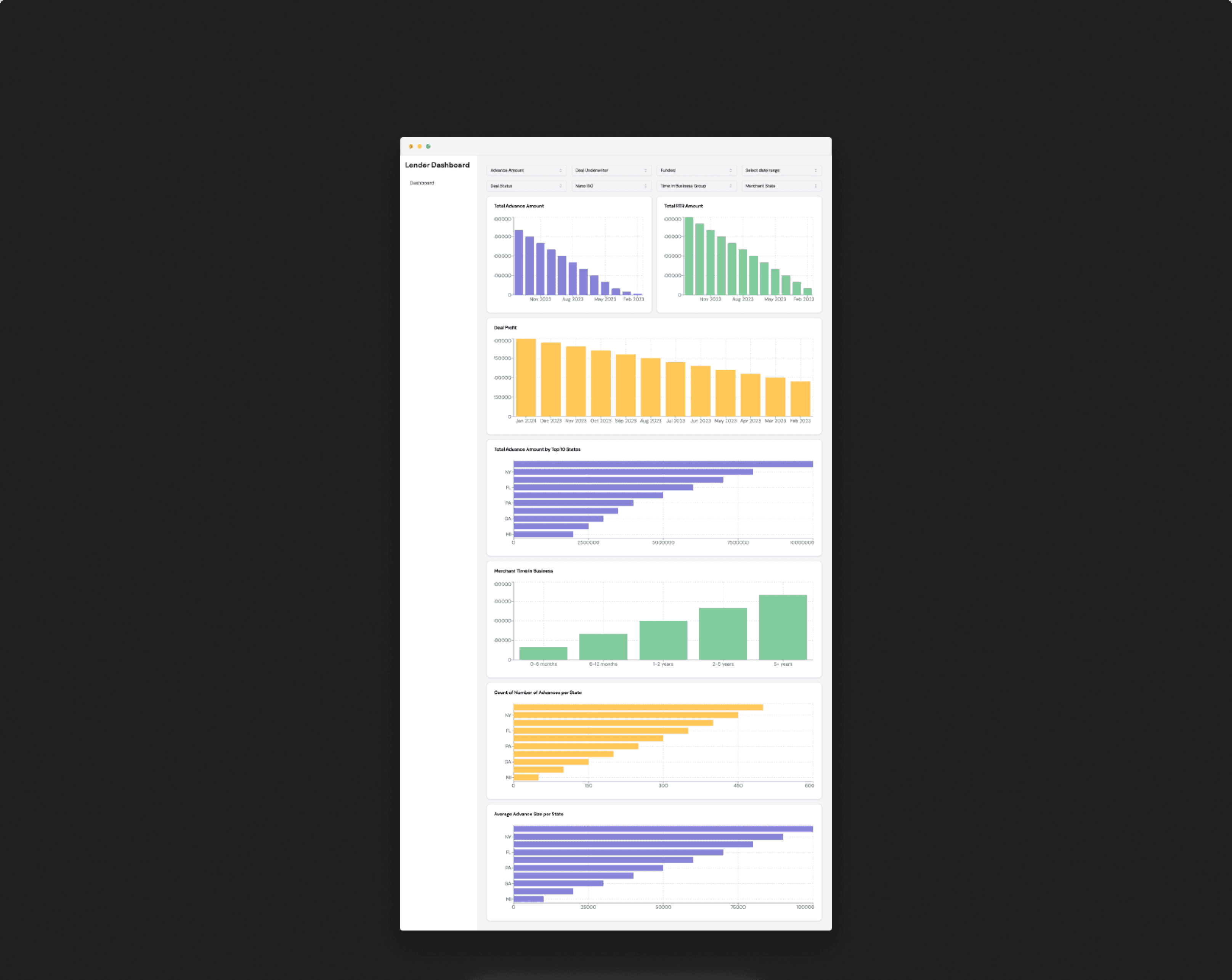

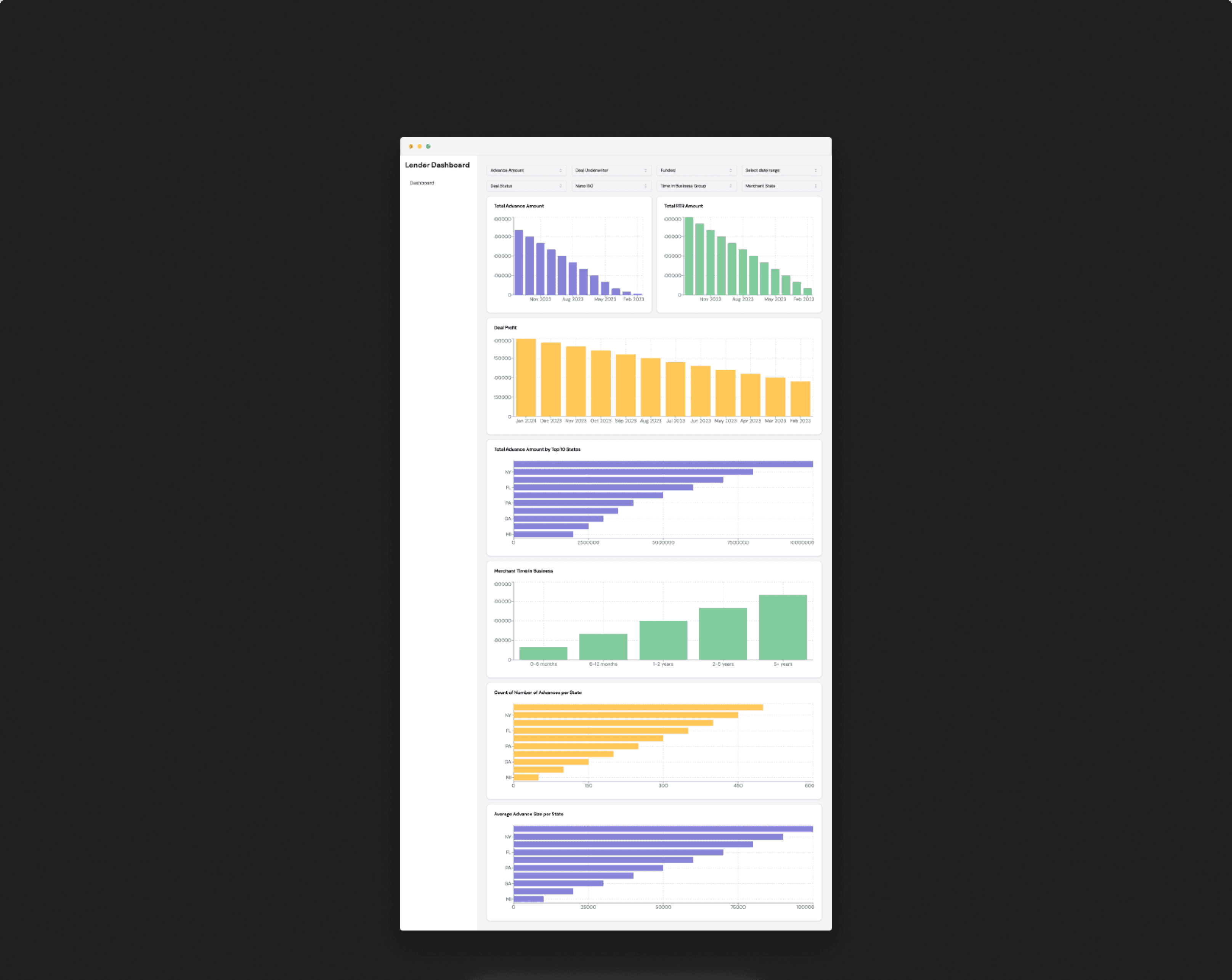

Our comprehensive technical support had a transformative effect on Reliance Financial’s operations. By automating critical workflows, we reduced manual effort by 40%, allowing their teams to redirect focus towards more strategic initiatives. The seamless integration of multiple third-party APIs, including QuickBooks and LendSaaS, improved the accuracy of their financial transactions, achieving a 95% accuracy rate by helping identify outliers and variances in their underwriting processes. This led to better pricing strategies for higher-risk deals and reduced financial errors. Additionally, the real-time access to key performance metrics and custom dashboards provided operational transparency across departments, empowering Reliance to make faster, data-driven decisions. The advanced workflow automations also streamlined payment processing, resulting in 100% error-free payment validations. Overall, our support helped Reliance Financial scale effectively, optimizing their technology infrastructure to meet growing data demands while ensuring seamless business operations.

A Proven Process

A Proven Process

A Proven Process

Our Path to Success

Our Path to Success

Identifying Core Challenges and Setting Clear Objectives

We began by aligning with Reliance Financial’s key business objectives and critical KPIs, gaining a clear understanding of their goals. This foundation ensured that all subsequent efforts would be tightly aligned with their overarching business vision.

Business-Focused Planning

Tailored technology roadmap to meet Reliance Financial’s specific operational goals.

KPI-Driven Strategy

Identified essential KPIs to guide development and track success.

Goal Alignment

Proof of Concept

Advanced Scaling

Iteration & Optimization

Identifying Core Challenges and Setting Clear Objectives

We began by aligning with Reliance Financial’s key business objectives and critical KPIs, gaining a clear understanding of their goals. This foundation ensured that all subsequent efforts would be tightly aligned with their overarching business vision.

Business-Focused Planning

Tailored technology roadmap to meet Reliance Financial’s specific operational goals.

KPI-Driven Strategy

Identified essential KPIs to guide development and track success.

Goal Alignment

Proof of Concept

Advanced Scaling

Iteration & Optimization

Identifying Core Challenges and Setting Clear Objectives

We began by aligning with Reliance Financial’s key business objectives and critical KPIs, gaining a clear understanding of their goals. This foundation ensured that all subsequent efforts would be tightly aligned with their overarching business vision.

Business-Focused Planning

Tailored technology roadmap to meet Reliance Financial’s specific operational goals.

KPI-Driven Strategy

Identified essential KPIs to guide development and track success.

Goal Alignment

Proof of Concept

Advanced Scaling

Iteration & Optimization

The solutions Dusseau implemented were instrumental in helping us better understand individual underwriting and ISO performance. Through advanced data analytics and flexible dashboards, we were able to view our business from multiple angles, gaining insights into large deals and identifying key patterns.

Chief Operation Officer of Reliance Financial

The solutions Dusseau implemented were instrumental in helping us better understand individual underwriting and ISO performance. Through advanced data analytics and flexible dashboards, we were able to view our business from multiple angles, gaining insights into large deals and identifying key patterns.

Chief Operation Officer of Reliance Financial

The solutions Dusseau implemented were instrumental in helping us better understand individual underwriting and ISO performance. Through advanced data analytics and flexible dashboards, we were able to view our business from multiple angles, gaining insights into large deals and identifying key patterns.

Chief Operation Officer of Reliance Financial

More Success Stories

More Success Stories

Join The Impact Lab!

Stay Informed with Our Latest business and tech Insights.

Case Studies

How Drive Hunger Away Empowers Local Heroes in the Fight Against Food Insecurity

How Fundrage Helped Sarah Find Meaningful Ways to Give Back

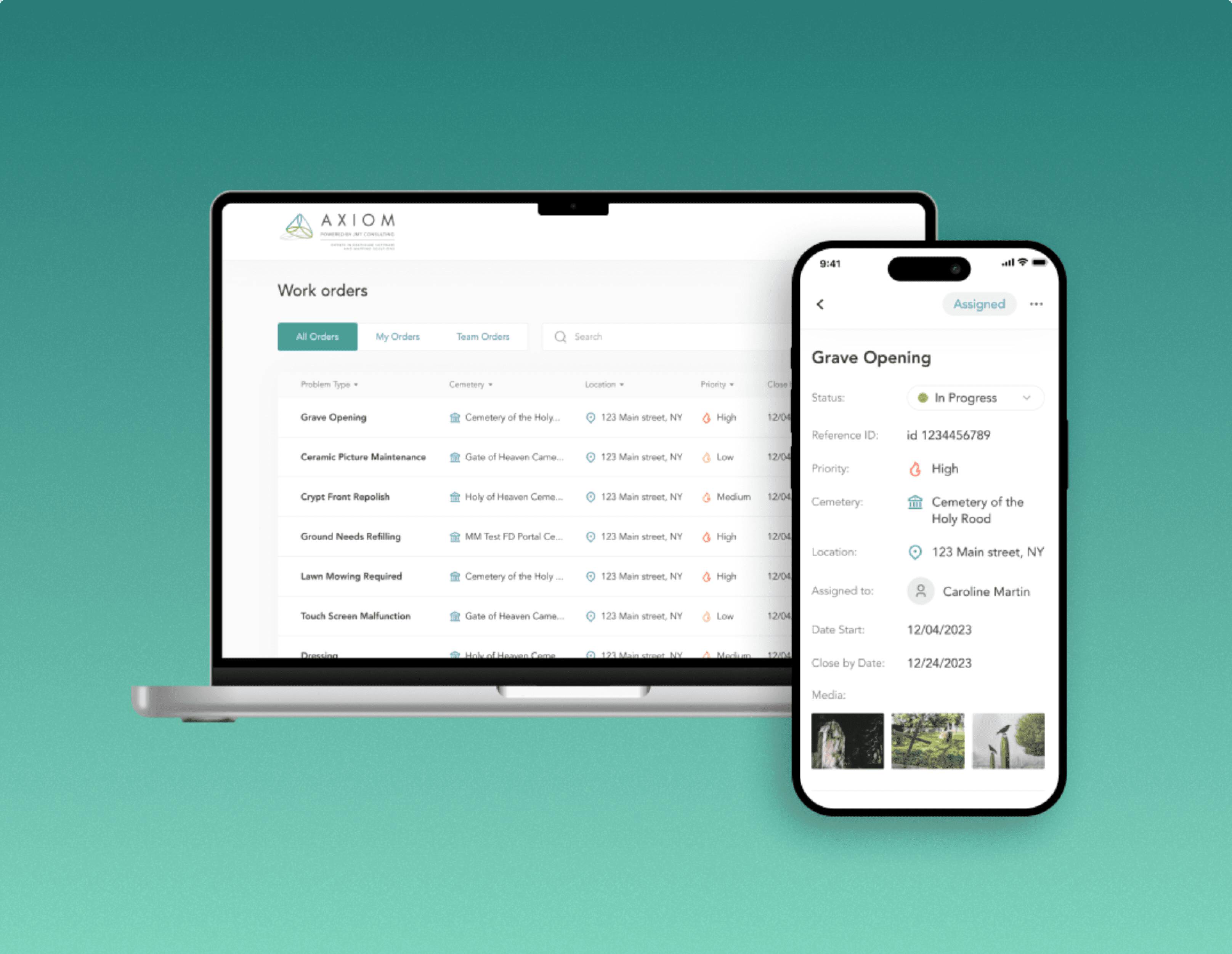

How We Streamlined Cemetery Management with a Modern, Secure, and Mobile-Responsive Solution

How We Improved Efficiency and Scalability for a SMB Lending Company by 73.5%

How We Enabled Enterprise-Grade Procurement for Large Enterprises with a 2-Month Digital Overhaul

How We Expanded Daily Active Users by 76% in Just 8 Months

How We Increased Vaccination Compliance by 97%

How We Reduced Feature Development Time from 1 Year to 2 Weeks for Empower Behavioral Health

How We Delivered a Fully Functional MVP in Just 3 months, Managing Over $300M in Real Estate Deals

How We Increased Productivity by 20% for an Asset Management Company

Services

What We Do

How We Help

Who We Help

How We Work

Pricing

Estimate your Project

About us

Our Leadership

Message from our Founder

Join The Impact Lab!

Stay Informed with Our Latest business and tech Insights.

Case Studies

How Drive Hunger Away Empowers Local Heroes in the Fight Against Food Insecurity

How Fundrage Helped Sarah Find Meaningful Ways to Give Back

How We Streamlined Cemetery Management with a Modern, Secure, and Mobile-Responsive Solution

How We Improved Efficiency and Scalability for a SMB Lending Company by 73.5%

How We Enabled Enterprise-Grade Procurement for Large Enterprises with a 2-Month Digital Overhaul

How We Expanded Daily Active Users by 76% in Just 8 Months

How We Increased Vaccination Compliance by 97%

How We Reduced Feature Development Time from 1 Year to 2 Weeks for Empower Behavioral Health

How We Delivered a Fully Functional MVP in Just 3 months, Managing Over $300M in Real Estate Deals

How We Increased Productivity by 20% for an Asset Management Company

Services

What We Do

How We Help

Who We Help

How We Work

Pricing

Estimate your Project

About us

Our Leadership

Message from our Founder

Join The Impact Lab!

Stay Informed with Our Latest business and tech Insights.

Case Studies

How Drive Hunger Away Empowers Local Heroes in the Fight Against Food Insecurity

How Fundrage Helped Sarah Find Meaningful Ways to Give Back

How We Streamlined Cemetery Management with a Modern, Secure, and Mobile-Responsive Solution

How We Improved Efficiency and Scalability for a SMB Lending Company by 73.5%

How We Enabled Enterprise-Grade Procurement for Large Enterprises with a 2-Month Digital Overhaul

How We Expanded Daily Active Users by 76% in Just 8 Months

How We Increased Vaccination Compliance by 97%

How We Reduced Feature Development Time from 1 Year to 2 Weeks for Empower Behavioral Health

How We Delivered a Fully Functional MVP in Just 3 months, Managing Over $300M in Real Estate Deals

How We Increased Productivity by 20% for an Asset Management Company

Services

What We Do

How We Help

Who We Help

How We Work

Pricing

Estimate your Project

About us

Our Leadership

Message from our Founder